Hindenburg Research has teased a new investigation in India, raising speculation about its next major target after the Adani Group.

Hindenburg Research, the US-based short seller known for its exposé on the Adani Group, has hinted at another significant disclosure involving India.

Founded in 2017 by Nathan Anderson, Hindenburg Research has a track record of targeting major corporations after conducting detailed investigations.

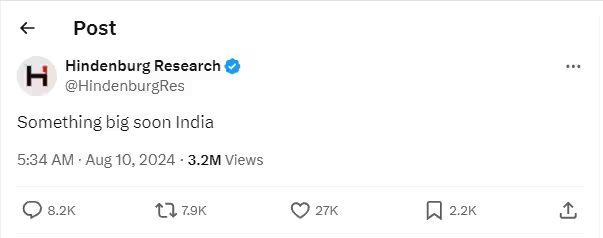

In a recent post on X, Hindenburg stated, “Something big soon India,” sparking widespread speculation about which corporation might be its next target.

In January last year, Hindenburg released a damning report accusing the Adani Group of orchestrating “the largest con in corporate history.”

The report’s timing, just before Adani Enterprises’ planned share sale, triggered a massive decline in the group’s stocks, wiping out approximately $86 billion in market capitalization. Additionally, the group’s overseas-listed bonds faced a significant sell-off in response to the allegations.

In June this year, the Securities and Exchange Board of India (SEBI) disclosed new developments in the ongoing Adani-Hindenburg saga, revealing ties between Hindenburg Research and New York hedge fund manager Mark Kingdon.

SEBI claimed that Hindenburg shared an advance copy of its Adani report with Kingdon about two months before its public release, allowing for substantial profits through strategic trading.

Hindenburg responded that SEBI had issued a notice accusing them of violating Indian regulations, which the firm dismissed as “nonsense.”

They argued that the notice was fabricated to serve a “pre-ordained purpose” of silencing and intimidating those who expose corruption and fraud by powerful individuals in India. Hindenburg explicitly named Kotak Bank in its report for the first time, adding another layer to the controversy.

Founded in 2017 by Nathan Anderson, Hindenburg Research has a track record of targeting major corporations after conducting detailed investigations. With around 10 employees, the firm has built a reputation as a short-selling “David” taking on corporate “Goliaths.”