How to Fill Your GST Return Correctly 2024-25

Filing your Goods and Services Tax (GST) return can seem daunting, but with a little knowledge and preparation, you can navigate the process with ease. Understanding the key components of the return and following a systematic approach will help ensure accuracy and compliance with tax regulations. This article will guide you through the steps to fill out your GST return correctly.

Understanding GST Returns – How to Fill Your GST Return Correctly

GST returns are periodic statements that businesses must file to report their sales, purchases, and the amount of tax collected and paid. The frequency of filing depends on your turnover and the specific rules of your country or region. Common types of GST returns include:

- GSTR-1: Details of outward supplies (sales).

- GSTR-2: Details of inward supplies (purchases).

- GSTR-3B: Summary return that includes the tax liability for the month.

It’s crucial to know which return applies to your business and its filing schedule.

Step-by-Step Guide to Filling Your GST Return – How to Fill Your GST Return Correctly

Step 1: Gather Necessary Documents

Before you start filling out your GST return, ensure you have all the required documents. This typically includes:

- Sales invoices

- Purchase invoices

- Credit and debit notes

- Previous GST returns

- Bank statements

Organizing these documents will streamline the process and reduce the likelihood of errors.

Step 2: Access the GST Portal – How to Fill Your GST Return Correctly

Most countries have an online GST portal for filing returns. Create an account if you haven’t already, and log in using your credentials. Familiarize yourself with the dashboard, as it will provide you with access to all necessary forms and previous filings.

Step 3: Fill Out GSTR-1 – How to Fill Your GST Return Correctly

- Details of Outward Supplies: Start by entering the details of your sales for the period. You’ll need to categorize them based on the applicable GST rates (0%, 5%, 12%, 18%, and 28%).

- Invoice Details: Input the invoice number, date, and customer information for each sale. Make sure to double-check these details against your sales records.

- Export and Zero-Rated Supplies: If you’ve made exports or zero-rated supplies, ensure these are recorded accurately.

- Reverse Charge Transactions: If you purchased goods or services from unregistered suppliers, include these under reverse charge.

Step 4: Fill Out GSTR-2 (if applicable) – How to Fill Your GST Return Correctly

Although many countries have simplified this process by allowing GSTR-3B to replace GSTR-2, if you need to fill it out:

- Details of Inward Supplies: Similar to GSTR-1, list all purchases, categorizing them based on GST rates.

- Matching with GSTR-1: Ensure that your inward supplies match the outward supplies reported by your suppliers in their GSTR-1. This step is critical for claiming input tax credit.

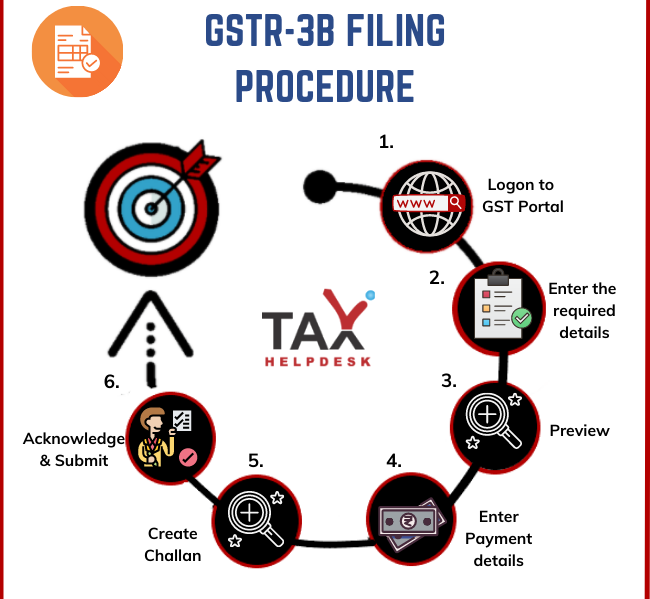

Step 5: Fill Out GSTR-3B – How to Fill Your GST Return Correctly

GSTR-3B is a simpler return that combines both outward and inward supplies. It’s a summary return and is typically due before GSTR-1.

- Aggregate Sales and Purchases: Enter the total sales and purchases for the period, along with the corresponding tax amounts.

- Input Tax Credit (ITC): Calculate the ITC you can claim based on your eligible purchases. Ensure all claims are supported by valid invoices.

- Tax Liability: After calculating your tax liability, ensure you correctly report any GST payable or refundable.

Step 6: Review and Validate – How to Fill Your GST Return Correctly

Before submitting your return, take the time to review all entered data. Look for any discrepancies or errors in calculations. The GST portal often has a validation feature that can help identify mistakes before submission.

Step 7: Submit Your Return – How to Fill Your GST Return Correctly

Once you are satisfied with the accuracy of your return, proceed to submit it. After submission, you will receive an acknowledgment receipt. Keep this receipt for your records, as it serves as proof of filing.

Step 8: Pay Any Due Tax –

If your return indicates that you owe tax, make sure to pay it by the due date to avoid penalties and interest. Payment can usually be made online through the GST portal.

Conclusion

Filling out your GST return correctly is crucial for maintaining compliance and avoiding penalties. By following these steps and staying organized, you can simplify the process and ensure that your returns are accurate. Remember, if you find the process overwhelming, consider seeking assistance from a tax professional. Staying informed about changes in GST regulations is also important, as this can impact how you file in the future. With diligence and attention to detail, you can successfully navigate your GST filing obligations.

Tags-: how to file gst return,gst return,gst return filing,how to file gst returns,how to fill gst return,how to file gstr 3b monthly return,gst/hst return,gst return filing in hindi,how to file gst/hst return uber,how to file gst/hst return online,gstr 1 return filing,gstr 3b return filing,how to file gstr 3b,hst return,how to file gstr 1,how to file gst/hst,gst return tutorial,gst return how to fill,how to gst return file,file monthly returns,

Struggling with stubborn fat? Here’s a solution that actually works. This simple hack is burning fat like you’ve never seen. No hours at the gym, just fat-burning power.